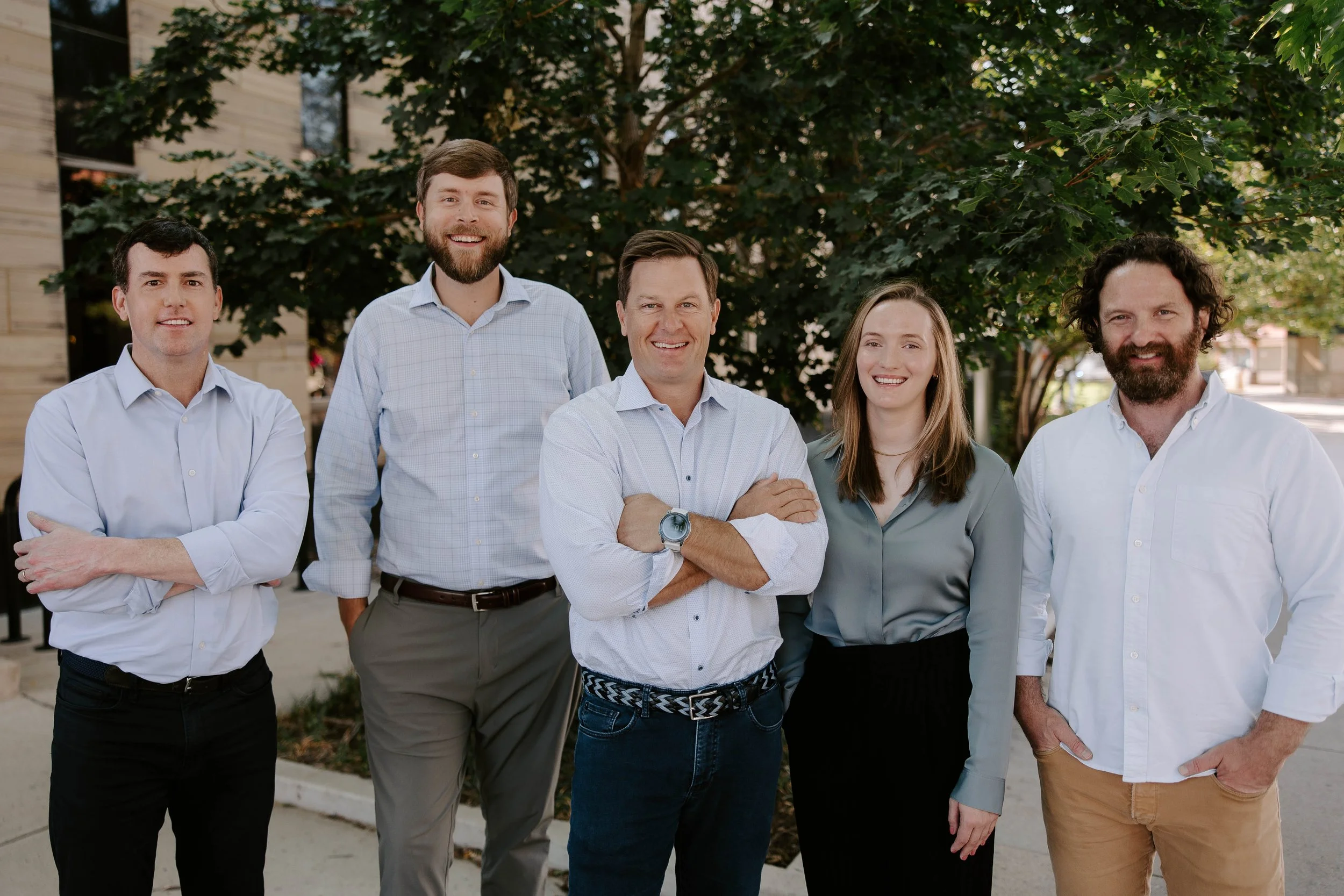

ReSeed Partners Strengthens Executive Team to Drive Scalable Growth

August 5, 2025 -- ReSeed Partners, a real estate private equity firm founded in 2023, announced today several key leadership changes designed to bolster its platform following a series of acquisitions earlier this year.

“Our team is our competitive advantage, and this group brings the leadership, expertise, and ambition to scale a durable, operator-centric platform that delivers value to our investors”

Doug McCrary has been promoted to President, where he will oversee strategic initiatives, partner relationships, and the full investment lifecycle across all managed funds. In his former role as CFO, Doug built the financial, legal, and underwriting frameworks that have supported ReSeed’s progress to date. In his new role, he will work closely with ReSeed’s operating partners to source, evaluate, and execute transactions that align with the firm’s disciplined investment strategy.

Laura Krannich has been promoted to Chief Platform Officer, a new role charged with leading the continued development of ReSeed's proprietary data and operations platform. Over the past two years, she has built the foundational infrastructure that powers the firm's data integration, reporting capabilities, and analytical processes across underwriting and asset management. In her new role, Laura will focus on scaling platform capabilities, optimizing operational workflows, and directing technology strategy to support the firm's expanding portfolio and investment activities.

Lee Thompson has joined the firm as Chief Financial Officer, responsible for all financial operations, capital markets relationships, and investor reporting and compliance. Lee comes to ReSeed Partners from Harbert Management Corporation, where he led portfolio reporting for a $4 billion infrastructure investment platform—experience he will leverage to support the firm’s expanding capital base and operational needs.

David Bergeron will transition to a Senior Advisor role, focusing on deepening relationships with capital partners and providing strategic guidance to the leadership team. David’s decades of real estate and business development expertise have meaningfully contributed to ReSeed’s foundation, and he will continue to lend his insight as the firm scales.

“Even after doubling the size of our platform this year, we are still in the early innings of building the premier sub-institutional real estate investment business,” said Rhett Bennett, Founder and CEO. “Our team is our competitive advantage, and this group brings the leadership, expertise, and ambition to scale a durable, operator-centric platform that delivers value to our investors.”

Bennett and Moses Kagan will continue in their roles as Investment Committee Chairs and remain deeply involved in driving the firm’s investment strategy and operator partnerships.